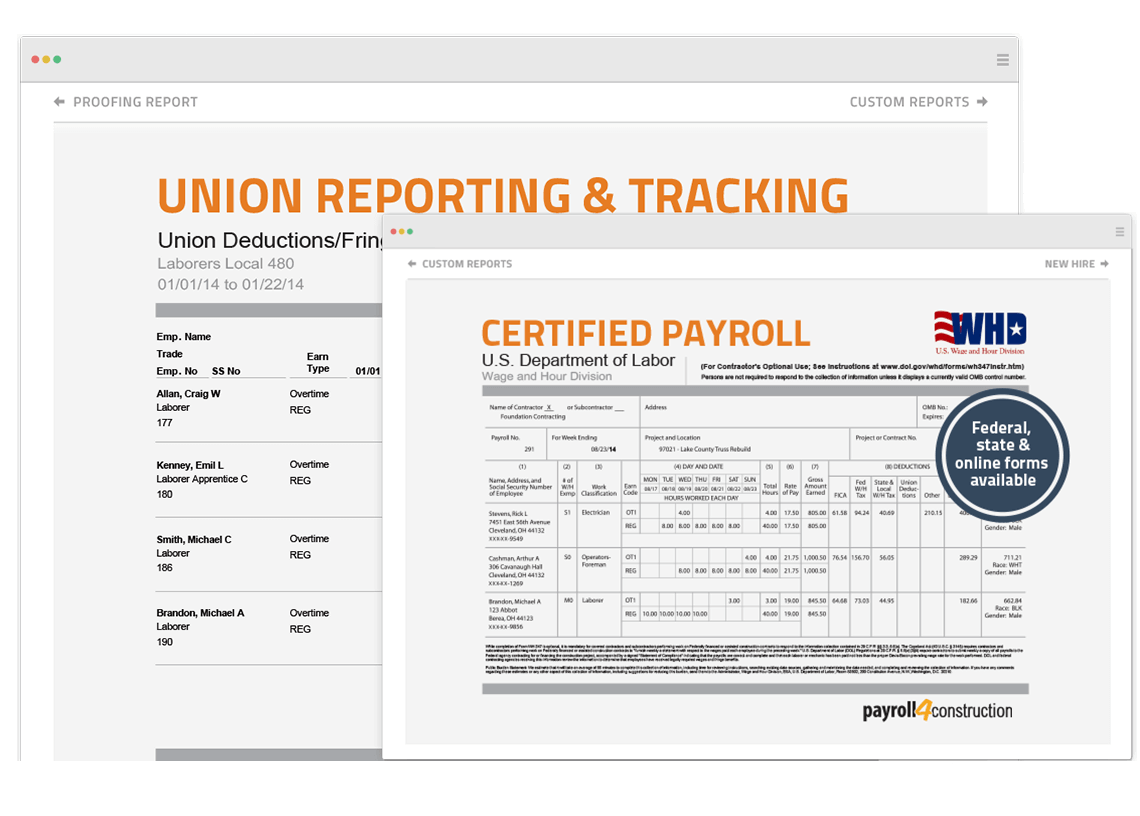

- Handle construction nuances like certified payroll reporting, union tracking and multi-state compliance

- Eliminate double entry by syncing payroll data with your HR data and field hours

- Automate labor calculations for faster, error-free payroll

Onboarding

Construction

Requirements

Payroll

Workload

Less Process in Your Payroll

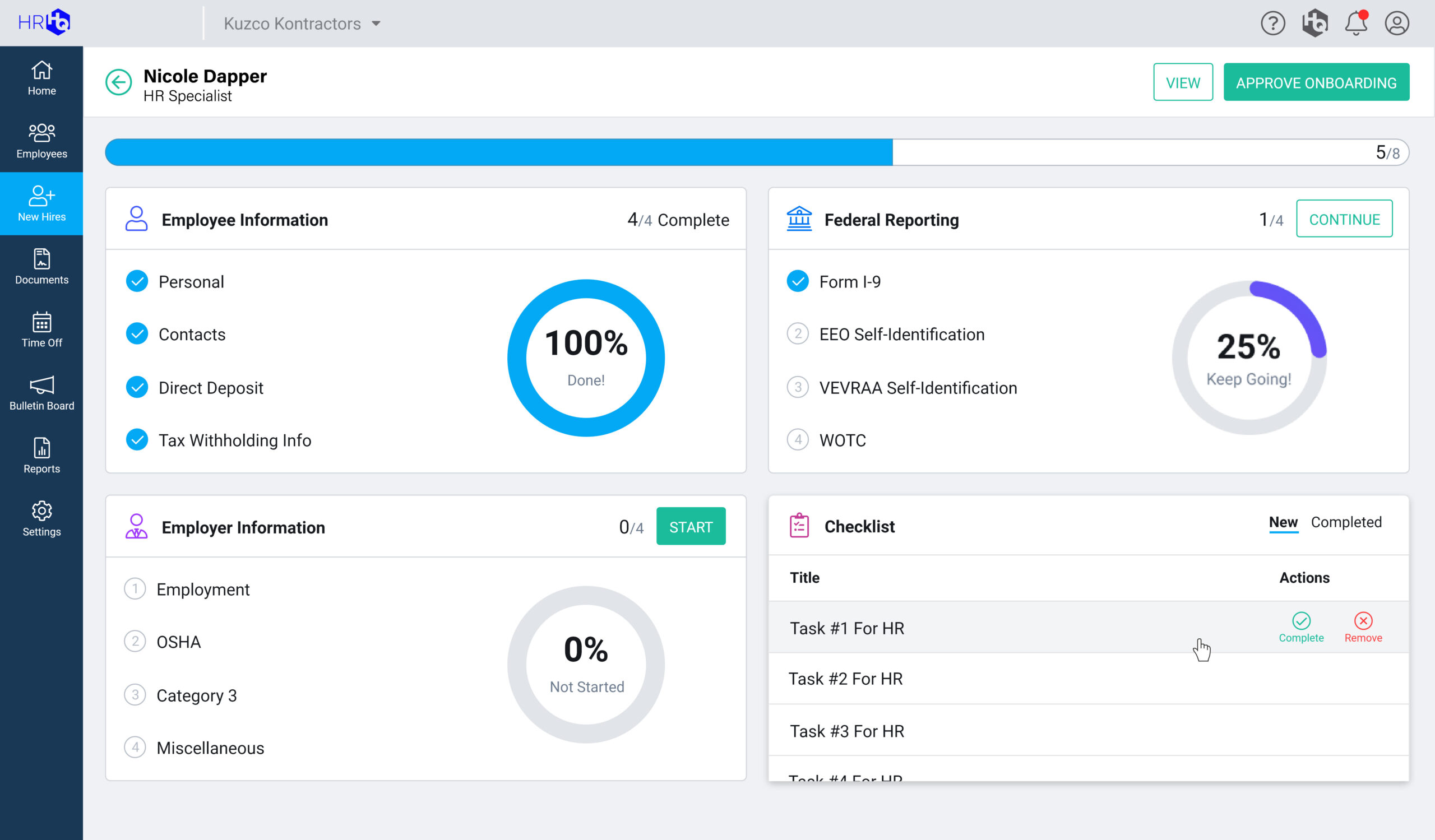

Employee Onboarding

- Digitally onboard new hires by sending them tax forms, direct deposit setup and benefit documentation before day one

- Reduce paperwork and rekeying with automated workflows that ensure complete, accurate records from the start

- Securely store all files in a central location to make them accessible to HR whenever needed

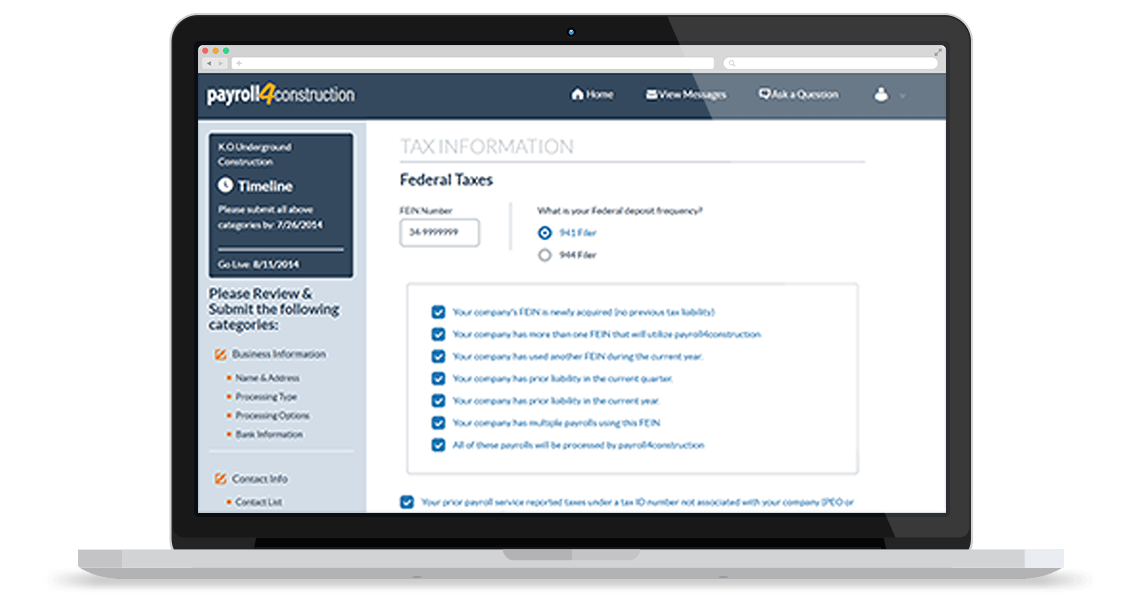

Payroll Processing

- Automatically calculate different rates and hours with the click of a button.

- Add multiple states, trades, rates and locations to a single timecard — no manual adjustments needed

- Easily track fringes, prevailing wages, deductions and other government pay regulations

Payday Services

- Let the experts print and mail checks and issue direct deposits

- Streamline year-end processes with services that distribute W-2s and help with ACA complications

- Never stress about taxes again with weekly, quarterly and annual filing assistance

Compliance & Reporting

- Create hiring and tax forms like W-2s, I-9s and new hire reports to meet federal, state and local regulations

- Generate free construction-specific reports, including certified payroll, union and job costing

- Maintain detailed audit trails with job costing reports, EEO/minority reports and other prebuilt compliance tools

Employee Self-Service

- Give workers 24/7 access to pay stubs, PTO balances, W-2s and benefits information from any device

- Allow employees to update personal info and request time off without involving admin staff

- Reduce paperwork and empower your team to manage their own records with confidence

Seamless Integrations

Streamline the payroll process by pairing WorkMax® with your construction accounting, payroll or HR solution.

WorkMax collects labor hours, which are then uploaded directly into your payroll or accounting system, eliminating the need for manual data entry.

Construction Payroll and HR Management Features

Certified Payroll

Union Tracking

Federal, Local & State Tax

Free Payroll Reports

Certification Tracking

Digital Document Sign-Off

Sync With Software

Free HR Reporting

Spanish Language Support

New Hire Onboarding

Performance Review

Multi-State Timecards

Construction Payroll Service FAQs

What Is a Construction Payroll Service?

A construction payroll service is a specialized provider that handles all aspects of paying your workers — from calculating wages and withholding taxes to processing payments and maintaining compliance records.

Unlike generic payroll companies, construction payroll services are purpose-built to manage the complex requirements contractors face, such as:

- Prevailing wages

- Union fringe benefits

- Multi-state/locality compliance

- Job-specific reporting

- Davis-Bacon Act requirements

- Certified payroll form preparation

Our solutions are purpose-built to handle the unique needs of the construction industry — accurately, efficiently and with full compliance in mind.

For any construction business managing multiple pay rates across different construction projects, a specialized payroll service ensures accuracy and Department of Labor (DOL) compliance.

How Can Human Resources Software Benefit a Construction Company?

HR software designed for construction helps:

- Centralize employee data

- Streamline onboarding

- Automate license and certification tracking

- Provide employee self-service access

- Track safety training and credentials

- Manage workers’ compensation documentation

- Monitor apprenticeship programs

Our connected HR tools reduce administrative workload, improve data accuracy and ensure compliance throughout your workforce. For any construction business, managing employee certifications and tracking various pay rates across construction projects becomes significantly easier with integrated HR software.

Can These Solutions Help With Managing Field Employees?

Absolutely! Our HR and payroll solutions support mobile access for time tracking, document management and employee data — so your field crews stay connected and on track from any jobsite.

Key benefits for field teams include:

- Real-time timecard submission from mobile devices

- Digital safety documentation and incident reporting

- GPS-verified jobsite location tracking

- Instant access to project assignments and schedules

With WorkMax, managing your workforce is just as easy in the field as it is in the office. Field workers across different construction projects can accurately record their hours, ensuring correct pay rates are applied and payroll taxes are calculated properly.

How Do Integrated Payroll and HR Solutions Improve Efficiency?

When your HR and payroll systems work together, you eliminate duplicate data entry, reduce errors and keep employee records consistent.

Benefits of integration include:

- Enter new hire information once and sync it across all systems

- Automatic synchronization of rate changes and promotions

- Unified reporting for labor costs and project budgeting

- Reduced processing time by up to 75% compared to manual methods

Our integrated approach helps streamline operations, save time and ensure accuracy. For construction businesses managing multiple construction projects simultaneously, integration means pay rates and payroll taxes are automatically updated across all systems, reducing administrative burden.

What Kind of Reporting Is Available for Construction Payroll?

Construction payroll solutions typically include reports like:

- Certified payroll (WH-347)

- Union reports

- Job costing by project or phase

- EEO/minority workforce reports

- Workers’ compensation

- Prevailing wage compliance reports

- Multi-state tax summaries

- Labor burden analysis

Our solutions provide these detailed, construction-ready reports to help you stay compliant and informed. These reports are essential for construction businesses to demonstrate Davis-Bacon Act compliance and to track labor costs across multiple construction projects.

Is It Possible to Track Employee Certifications and Training with These Solutions?

Yes, you can track licenses, certifications and employee training in one centralized system.

Certification management features include:

- Automated expiration alerts for licenses and credentials

- Digital storage of training certificates and safety cards

- Safety certification tracking

- Trade-specific license and qualification monitoring

- Compliance dashboards showing workforce readiness

Set alerts for upcoming expirations and stay ahead of compliance with tools that keep your workforce fully qualified. This is especially critical for construction businesses working on government projects where Davis-Bacon Act requirements mandate specific certifications and Department of Labor (DOL) documentation.