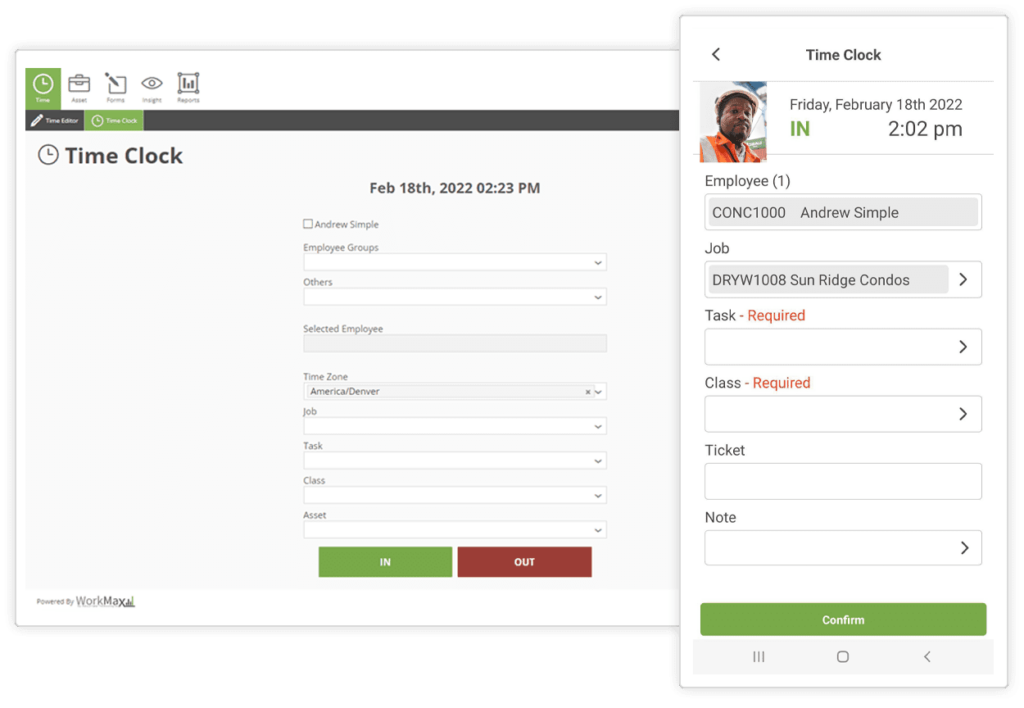

Easily track your time with construction’s #1 time tracking app. Click below to explore WorkMax.

Don’t Miss Out on Section 179 Tax Credits

Software purchases oftentimes qualify for Section 179 tax credits. That means you can get WorkMax, and its award-winning construction accounting features, for less!*

*Consult with your CPA for more information on tax savings.